With the cost of living constantly increasing, it can be difficult to understand why the Bank of England has chosen to increase interest rates. Why increase the rate of interest when this will make mortgages more expensive? Join us as we investigate why this is the case

What is inflation?

Inflation is when an economy’s goods and services see a general increase in price. The rate of inflation is a measure of the speed of this increase; a higher rate of inflation means prices are generally increasing quicker

Inflation reduces the purchasing power of consumers’ money. In a nutshell, they get less “bang for their buck”

What is disinflation?

Disinflation is when the rate of inflation is reduced. This is the current aim of the Bank of England. In order to keep inflation stable, they aim to keep it at a rate of 2%

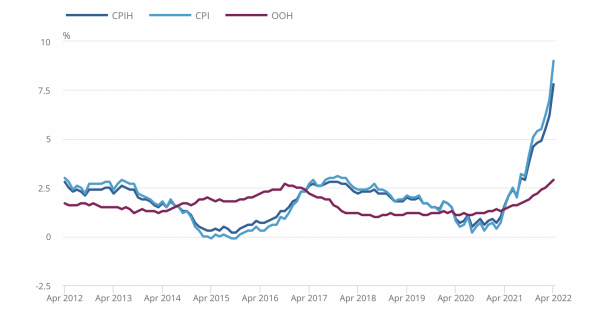

The CPIH is the Consumer Price Index, taking into account housing costs

As you can see from the above figure, inflation is currently far above this target. In fact, the Bank of England has predicted that the rate of inflation may reach over 13% this year

For those who wish to look further into the changing inflation rate over the years, we recommend checking out the Office of National Statistics

Measures must be taken to reduce this inflationary pressure… this is where the increased interest rate comes into play

The effect of interest rates on inflation

By increasing interest rates, the Bank of England is aiming to discourage consumer borrowing and encourage consumer spending. By saving more and thus spending less, the idea is that there will be less inflationary pressure stemming from consumer demand

On the 16th June 2022, the Bank of England’s base rate of interest rose from 1% to 1.25%. As of the 4thAugust 2022, this has increased to 1.75%, serving as the biggest rise in the last 15 years

What does an increased interest rate mean for you?

- Mortgage rates will increase for any homeowners that aren’t on fixed rate deals

- You will have a higher rate of interest on your savings, meaning more money in the account. However, inflation is still eating away at the purchasing power of money so it is still reducing in value

- You will have a higher payments for money borrowed on credit cards or loans

- One of the main drivers of inflation is the increase in price of wholesale gas prices, of which higher interest rates will not bring down

A recession?

A recession is when there is a prolonged downturn in economic activity for two or more consecutive quarters (each quarter being 3 months long)

The Bank of England has warned that we are likely to enter a recession later this year, which is predicted to last as long as 5 quarters

Whilst this all seems like a very grim outlook, there are ways of dealing with these difficult times. Check out this blog for help in managing your finances during a recession

2 thoughts on “Why are interest rates rising?”