We all hear the word ‘inflation’ so much that you’re probably sick of it. However, stagflation seems to be a topic less talked about. With the risk of stagflation having increased in the UK, we think it’s important to have a quick rundown of what this actually means

The Different Types of ‘-flation‘

- Inflation- a general rise in prices, meaning you get less for your money

- Disinflation- a fall in the rate of inflation. Prices are still rising but at a slower rate

- Deflation- a general fall in prices

- Stagflation-persistent high inflation, coinciding with high unemployment and slow economic growth. It is a combination of both ‘stagnation’ (slow growth, no wage increases and high unemployment) and ‘inflation’

Stagflation is a Rareity

Until the 1970s, most economists shared the belief that inflation and unemployment have an inverse relationship. This means that when inflation increases, unemployment tends to decrease. However, we now know this is no longer the case

What Happened in the ’70s?

We haven’t faced stagflation since the 1970s. This economic situation was caused by the oil crisis acting as a supply shock

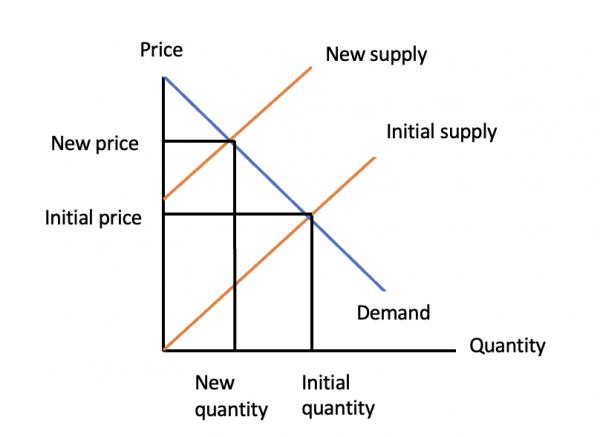

The oil crisis meant the UK and US could no longer import oil from the Middle East. Continued strong demand with a huge restriction on supply meant that oil prices shot up by a whopping 300%

As shown by the above diagram, when supply restricts, prices are pushed up

What Causes Stagflation?

- Supply-side shocks, such as labour shortages or the example of the 1970s oil crisis

- Certain fiscal and monetary policies, e.g, government spending being too high, or interest rates being too low

What Would it Mean for Us?

- Stagflation would hit the average UK household hard; it would mean people’s wages weren’t keeping up with the price increases of goods and services

- It would essentially be a worsening of the current cost-of-living crisis

Once it starts, it is difficult to reverse

Managing inflation involves a reduction of the flow of money to reduce inflationary pressures caused by high demand. For example, the recent government decision to raise the interest rate to 1.75% is a way of trying to counter inflation

On the other hand, managing a recession usually involves an influx of money into the economy to kickstart economic activity and encourage spending. Part of this could be lowering the interest rate

Given that stagflation is a combination of both of these, it is very difficult to solve, as these are two completely opposite approaches

Stagflation can be dealt with by dealing with the supply-side shock that caused it as quickly as possible. Then, action should be taken to reduce inflation before dealing with the stagnation aspect

Will we enter a period of stagflation?

In its latest Financial Stability Report, The Bank of England has said the outlook of the UK economy “is subject to considerable uncertainty”. Click here to read the full report.

As discussed in one our previous blogs, inflation is estimated to reach 13% later this year, meeting the first condition of stagflation

However, the UK’s GDP actually rose by 0.5% over the 3 months preceding April this year. This said, this growth could certainly end up being negated if there is a drop later this year caused by the cost-of-living crisis reducing spending. Additionally, whilst our unemployment rate is actually low, there are still labour shortages caused by Brexit and Covid reducing the size of our labour force

However…

The average inflation of Great Britain in 1975 was an enormous 24.11% so we aren’t in the same boat yet

We can’t predict for certain exactly what will happen to the economy. At the end of the day, we aren’t psychics or oracles! All that this info means is that the risk of stagnation has increased, not that it is inevitable and unavoidable