Every investment contains an element of risk, but this shouldn’t put investors off. There are ways of managing this risk, through diversifying investment portfolios and looking at longer-term market trends

Risk Analysis

Investment is not just risk, it is also offers rewards. When looking at investment opportunities, investors should consider its potential risks and decide how much risk is right for them. Diversification can also be used as a technique to reduce risk. Here, investors spread out their investments across various industries and areas that would react differently to the same event

What kind of events does this encompass?

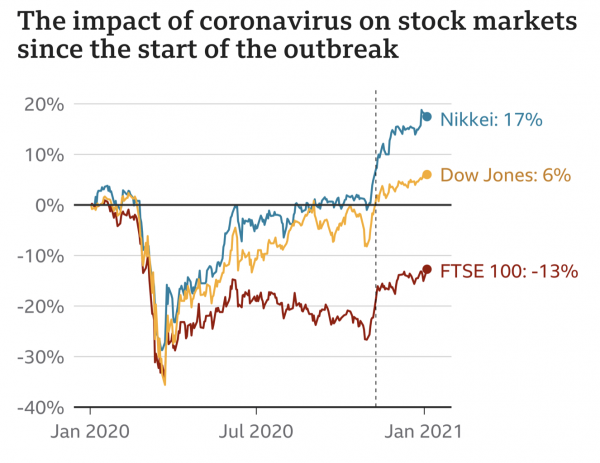

This includes a range of financial, economic and political factors- basically, anything that may cause investor confidence to fall. The recent COVID- 19 pandemic is a prime example of this, as it impacted almost every sector and caused high levels of uncertainty. This is shown by the fall in the FTSE 100 index, as illustrated below:

What is the FTSE 100 Index?

The Financial Times Stock Exchange (FTSE) 100 Index is the share index of the 100 companies with the highest market capitalisation on the London stock exchange. It can be used to draw comparisons with other countries, to see how a certain sector is performing in England compared to elsewhere. It is also a great indicator of investor confidence; if it falls heavily, confidence is down, and if it rises, there is less uncertainty amongst them

However…

some areas experienced growth during the pandemic, such as streaming services and anywhere with adequate online systems. This highlights the complexity of investment; there is no perfect choice, but this is why it is important to diversify in order to spread out the risk

Looking at the long term

The FTSE 100 Index still has a trend of long term growth despite these peaks and troughs in the market. This illustrates how important it is to look at the bigger picture when investing, rather than making decisions based entirely on short-term stock performance

Uncertainty in the stock market can lead to panicked decision-making, but it is important to try to keep a level head. Investors shouldn’t keep entering and exiting the stock market based on its short term performance. The market will always be subject to fluctuations, so if the price of a stock falls, it is more than possible that it will recover in the future. Holding onto your stocks in case the situation improves, rather than selling them at low prices when its value has fallen, is a great way of investing in the long-run

2 thoughts on “The Importance of Long Run Investment”