Though the Bank of England has not officially predicted a recession later this year, it is looking increasingly likely. This is due to the huge increases in the rate of inflation and the labour shortages continuing from Brexit and Covid. Here are some ways of preparing your personal finances in case a recession takes place.

Save, save, save

It may be a good idea to start building up your savings account, wherever possible. Having a strong emergency fund means you are prepared for unexpected costs. You never know what’s round the corner so it is best to prepare for the worst and expect the unexpected.

For example, your income may reduce from either losing your job or having your hours cut down due to less consumer demand in the economy. This would make essential payments harder to deal with, especially those arising out of the blue, such as your car breaking down or your bills rising (the latter being incredibly likely at the moment).

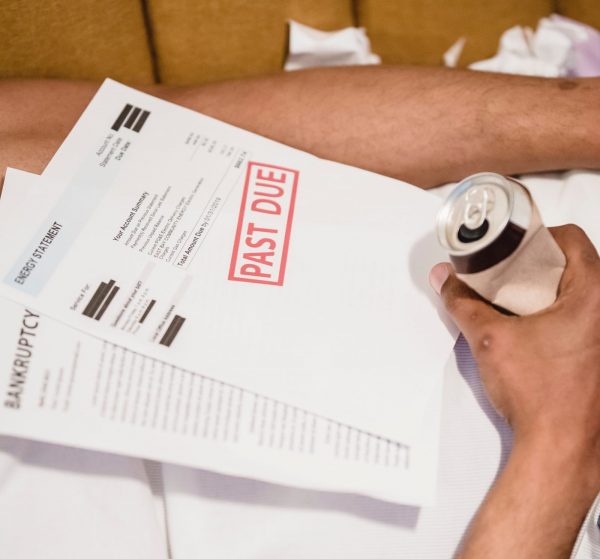

Go Debt Free

Try to pay off existing debts wherever you’re able to. Consider making a debt repayment plan… this could involve paying off priority debts first, before focussing on the ones with the highest interest rates in order to save money on interest repayments.

Priority debts are things like gas and electric bills and mortgage arrears (missed mortgage payments). These debts should be prioritised as they have the potential to cause the most issues, such as having your electricity cut off, or losing your home.

Avoid taking on any extra debts as you don’t want the amount you owe to become unmanageable

Shop Around

You can try to reduce your expenses by switching to cheaper options. Even though switching accounts can be a pain, it’s worth it in the long run.

If your weekly shop costs a bomb, maybe try to find a cheaper supermarket and cut down on certain luxury goods. If there’s ever a time to be frugal it’s now.

Avoid Investment Panic

Don’t let panic affect your investment choices. You shouldn’t let emotion cloud your judgement. Your investments dropping in value in the short-run during a recession does not mean they lack long-run profitability. For more info on this, check out this previous blog on the importance of long run investment.

It’s also worth considering diversifying your investments now so that one industry facing a decline during recession doesn’t sink your whole portfolio.