Earlier this week, a new sub-1% mortgage was launched for new build buyers.

Own New’s Rate Reducer

As of Monday, Virgin Money and Halifax are offering mortgages with rates potentially below 1% for those with high deposits or equity who are buying new build homes.

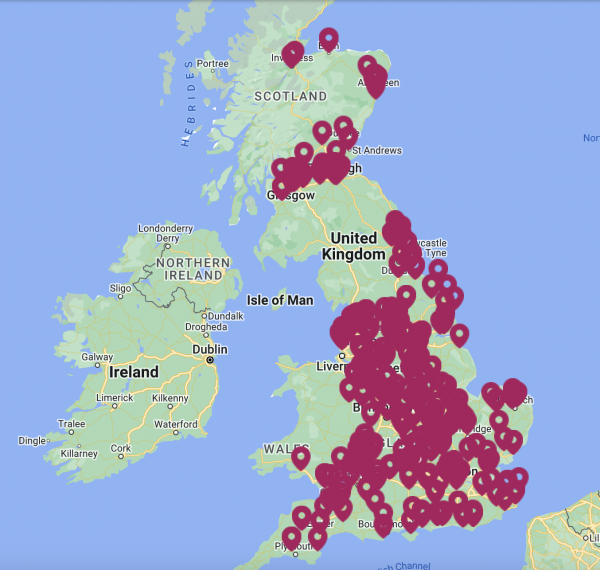

These new low rates come from Own New, who teamed up with housebuilder, Barratt Developments to introduce their ‘Rate Reducer’ scheme.

More housebuilders are due to join the scheme this coming Monday, with more mortgage providers also set to offer mortgages through Own New.

How Does it Work?

The Rate Reducer works by using incentive budgets offered by housebuilders to customers to reduce their monthly mortgage payments over a fixed term. Buyers can choose to spread the incentive over the first 2 or 5 years of the mortgage term depending on their lender’s criteria.

These mortgages will still require lenders to carry out affordability assessments to ensure that borrowers will still be able to meet repayments once this fixed term benefit ends and they face higher interest rates.

What Have People Had to Say?

There appear to be mixed opinions when it comes to these new low rates, with some commentators noting that the Rate Reducer will help make mortgages more affordable, stepping in to fill the gap left by Help to Buy… whilst others believe that it could lead to rises in house prices and could leave homebuyers worse off.

“Our ethos is to make home ownership and mortgage lending in this country open to more people and we are confident that the launch of the Own New Rate Reducer will achieve that” – Elliot Darcy, founder of One New

“This will help target one of the key barriers for many and give buyers more breathing space in their monthly payments” – David Hollingworth, associate director at L&C Mortgages

“This product gives customers more choice in the way they can benefit from builder incentives and is especially helpful to those who want to see a lower initial mortgage payment as they get set up in their new home.” – Amanda Bryden, head of Halifax Intermediaries

“Since the demise of Help to Buy, the market has been crying out for a scheme to help get people onto the property ladder.” – Terry Higgins, managing director at The New Homes Group

“this is a dangerous scheme in that buyers will get used to the lower payments and when that initial product ends they will be faced with a large increase in their payments.

Ultimately, though, like the Help to Buy scheme that preceded it, this scheme will see developers just increasing their house prices leaving the potential buyers no better off at all, whilst also sacrificing the other incentives they would have been able to secure” – Stephen Perkins, MD at Yellow Brick Mortgages

“Without a doubt developers will use these affordable mortgages to increase house prices, meaning a premium will be paid for own new stock, and the payment shock at the end of the product will be enormous.

Will the buyer be advised correctly? Doubtful. This has disaster written all over it” – Matthew Jackson, director at Mint FS

Sources: