More and more UK adults are adopting a gradual approach to retirement. In this blog, we will analyse findings from a 2022 study conducted by Smart Pension to gain an insight into changing attitudes towards retirement in the UK.

Thinking About Retirement

Since the introduction of auto-enrolment in October 2012, many workers automatically save into a pension without consciously having to make the decision to do so. This has helped to get a lot more people saving for retirement.

However, it’s still important for us to actively think about our pension and to try to maximise contributions where possible, as our pension pot will need to last us a significant length of time.

Lack of Understanding Surrounding Retirement Options

According to Smart Pension’s 2022 study, 29% of UK adults don’t have a clear understanding of the options available to them in retirement.

This figure is down from 39% in their 2021 survey, reflecting positive change in terms of how we understand our retirement options.

However, there is still a significant gap in our nation’s pension knowledge that needs to be filled.

Retirement as a Gradual Process

Smart Pension also found that retirement is now seen as more of a gradual thing, with 47% of UK respondents seeing retirement as a transition rather than a one-off event.

This makes sense, given that going from working, especially under full-time hours, to not working at all, can be an enormous lifestyle change that could seem jarring. Therefore, more and more people are reducing their working hours as a way to gradually phase in retirement.

Concerns in Retirement

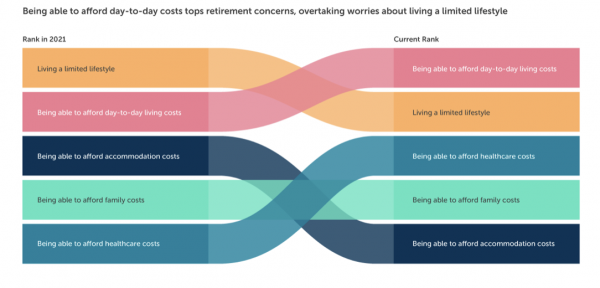

The above image illustrates Smart Pension’s findings on respondents concerns about retirement.

In 2021, the biggest concern of UK respondents was having to limit their lifestyle in retirement, whereas in 2022, being able to afford daily living costs was the biggest concern. This demonstrates the impact that the continued cost-of-living crisis is having on the UK population.

Another interesting point in these findings is that in 2021, being able to afford healthcare costs in retirement was at the bottom of the list of concerns at number five, whereas in 2022, this concern leapt up to third place.

Given that we are a nation with a free national healthcare system, this is somewhat troubling, as it may link to our increasing uncertainty surrounding the future of the NHS, with many being forced to seek private treatment due to lengthy waiting times.

Supplementing Income

18% of respondents plan to supplement their pension with continued employment. Perhaps one reason behind this comes down to that earlier finding, where many are worried that they won’t have enough income in retirement to cover day-to-day living costs.

We can access most private pensions from age 55, meaning that there isn’t really a set retirement age; you can keep working for as long as you like whilst also drawing on your pension.

However, if you do continue to work whilst drawing a pension, you will lose more of your pension in tax. This is because income from your pension is treated the same as any other income, meaning that once you have used up your personal allowance, the rest of your income will be taxed in the relevant band.

The personal allowance is £12,570, so if you work whilst drawing from your pension, and the total income is below this level, you will not be taxed.

It’s worth noting here that you can’t start claiming your State Pension until you reach the State Pension age.