The International Monetary Fund (IMF) has upgraded the UK’s economic growth forecast earlier this week, with predictions that the UK economy will contract by 0.3% rather than 0.6% as previously forecasted. However, this contraction still sees the UK settling into its position as the worst performing G7 economy this year.

IMF’s UK Predictions

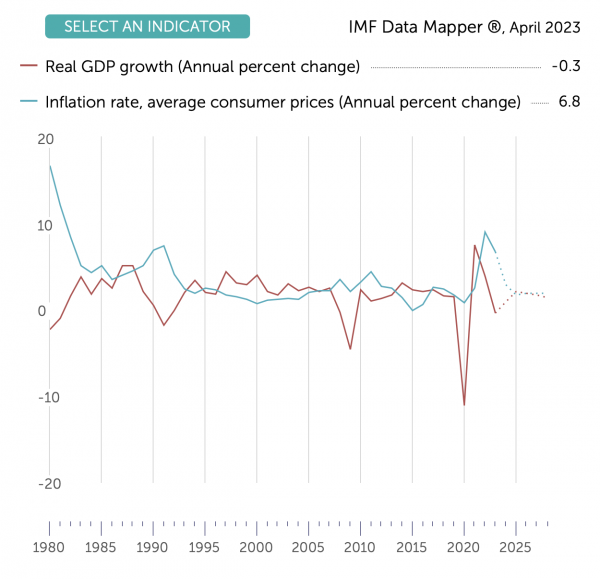

Here you can see that the IMF predict 0.3% negative real GDP growth alongside a 6.8% inflation rate in the UK for 2023.

The rate of inflation is certainly heading in the right direction when compared to its rate of 9.1% last year. Nevertheless, this is still far higher than the Bank of England’s 2% target rate of inflation.

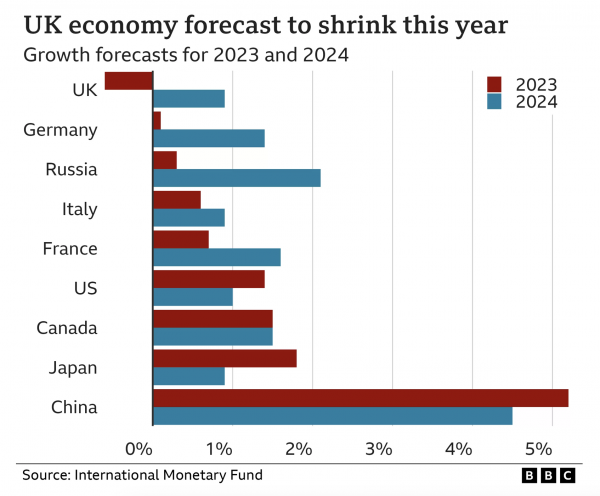

The above graph, taken from BBC News, using IMF data, shows UK growth forecasts in 2023 and 2024 in comparison with other G7 countries.

This graph clearly illustrates that the UK is facing a very different situation to its companions, acting as the only G7 nation with negative growth for 2023.

This said, it does also appear that we are on the right path, as despite predictions of a 0.3% contraction in GDP this year, the IMF also forecasts that we will move away from this shrinkage and into growth of 0.9% in 2024.

Given that the IMF has reduced how much they expect our economy to contract this year and increased the growth they predict us to experience next year, we can certainly see an increasing optimism in the UK’s economic outlook.

The Mini-Budget’s Aftermath

One of the reasons for the decline in the UK’s economic environment is the continued aftershocks of Kwarteng’s September mini-budget under Truss’ leadership.

“In the UK, investor concerns about the fiscal and inflation outlook after the announcement of large debt-financed tax cuts and fiscal measures to deal with high energy prices weighed heavily on market sentiment in late September. Amid high market volatility, the British pound depreciated abruptly, while yields on UK sovereign bonds rose sharply. The scale and speed of yield increases, especially at the long end of the curve, reportedly had a significant impact on levered positions held by UK institutional investors, particularly pension funds”

–Chapter 1 – Financial Stability in the New High-Inflation Environment; October 11, 2022

The fiscal policy proposed in the September mini-budget worked to counteract the Bank of England’s monetary policy. This is because Kwarteng proposed unfunded tax cuts in a somewhat frenzied attempt to stimulate economic growth, whilst the Bank of England sought to stabilise inflation through interest rate rises (which of course have the opposite effect on growth).

If we combine the aftermath of the mini-budget with continued high energy prices, rising mortgage costs and continued labour shortages, the IMF’s forecast comes as little surprise.