The last few years have witnessed a rise in direct cremations, wherein the body of the deceased is cremated without a service and the ashes are given to the family.

Findings from SunLife’s Cost of Dying 2023 Report

Sunlife’s Cost of Dying 2023 Report found that 1 in 4 people who organised a funeral were surprised by costs. Funerals can be distressing to think about, and we often avoid doing so until a point where we have to. However upsetting, it’s still an important topic, as it can be a significant cost for people to shoulder.

Sunlife stated, “More and more we’re seeing people report actively trying to cut back, to keep their funeral spend as low as possible- no surprise given the current economic situation. Unfortunately, we’re also seeing fewer people covering costs with savings and investments, and more having to borrow money.”

Here, we can see the issue… funerals are expensive, and many are either unwilling or unable to pay the cost. So, how are people responding to the cost of funerals?

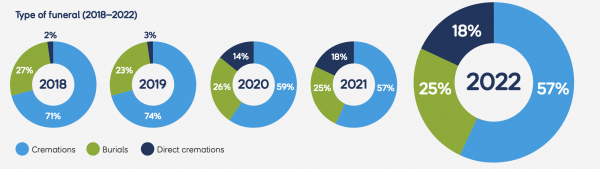

Here, SunLife shows the changes in funeral patterns over 2018-2022. As we can see here, there has been a significant rise in the number of those turning to direct cremations. The leap upwards from 3% in 2019 to 14% and 18% in 2020 and 2021 respectively, is understandable, as much as this trend can be attributed to Covid-19 restrictions. However, even with Covid-19 under control, the popularity of direct cremations is still going strong.

Much of this popularity stems from its price. SunLife found that the average funeral cost in the UK for 2022 was £3,953, whereas the average cost of direct cremation was £1,511.

Why Price is a Huge Factor

Many don’t want their loved ones to be financially burdened by their death and so are requesting that they’re given a direct cremation upon their death.

Even if they have the money to cover their funeral costs, many would rather leave this as an inheritance for their loved ones.

This said, a funeral tends to be for the benefit of the living, for those who are left behind when we die. It can be beneficial to the grieving process and coming to terms with the death of a loved one.

Paying for your Funeral

Many choose to pay up front for their funeral or ensure they leave enough money behind to cover the costs. You can do this by:

- Taking out a prepaid funeral plan

- Taking out life insurance. Your beneficiaries can then use some of the lump sum paid to them when you die to pay for your funeral

- Paying for it with your savings or estate