Good news, the rate of inflation is falling…

Falling Inflation

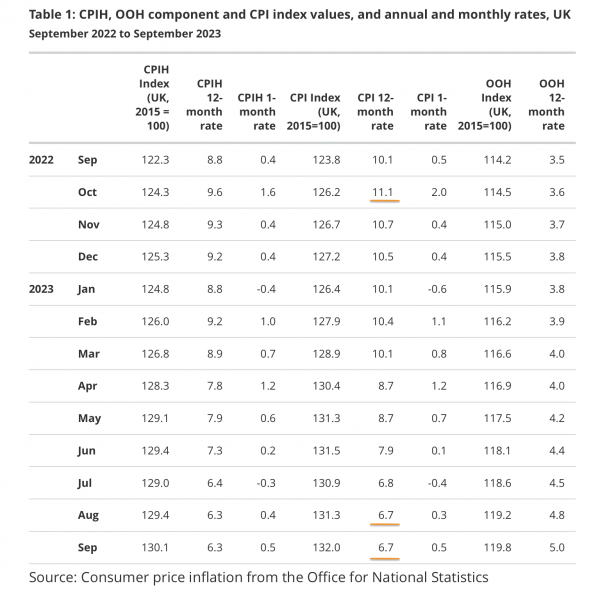

Inflation in the UK hit heights of 11.1% in October last year, creating a big strain on our purse strings. However, this has fallen to 6.7% in August and September this year. See figures underlined in orange below:

The Bank of England say they expect inflation to fall further in the coming months, with predictions of a rate of around 5% by the end of the year.

They also expect inflation to continue to fall in 2024, reaching the target rate of 2% in the first half of 2025.

It is important to note here that a fall in inflation (disinflation) does not mean goods and services are getting cheaper (which would be deflation). It simply means that the rate of inflation is decreasing, so costs are still rising, it’s just happening more slowly.

Food Costs

The rate of inflation for food and non-alcoholic beverages is much higher than the average overall inflation rate. This is because the inflation rate is an average, and the prices of different goods and services rise at different rates.

48% of Great British adults say they have spent more than usual to get their usual food shop within the last two weeks.

However, the inflation rate for food and non-alcoholic beverages has eased to 12.2% in September this year, acting as a decrease from 13.6% in August and from highs of 19.2% in March.

Why is Inflation Falling?

One key reason why the Bank of England expect continued disinflation is that energy bills should reduce more due to recent falls in gas prices.

They have also stated that higher interest rates will help bring down inflation further. This is because higher interest rates discourage spending by decreasing the cost of borrowing and increasing the reward of saving money.

What About Wages?

In June to August 2023, annual growth in regular pay for the public sector was 6.8%, acting as one of the highest regular annual growth rates since 2001. However, this rise was 8% the private sector, meaning there remains a gap between public and private wage increases.

Importantly, data from The Office of National Statistics (ONS) shows a positive annual growth rate in real pay for August 2023 (real pay accounts for inflation). This is certainly much needed to help reduce some of the pressure on household budgets among the continued cost-of-living crisis.