Islamic finance continues to be a growing success story both in the UK and globally.

An Introduction to Islamic Finance

Institutional Islamic finance started to emerge in the 20th century and the Islamic financial sector continues to grow at high rates every year.

Islamic finance is a broad term, covering a range of products, services and firms, but it is essentially a way of managing money in a way which complies with the moral principles of Islam and Shariah law.

Anyone can use Islamic finance products and services, regardless of whether they themselves are Muslim.

Continued Growth

The Refinitiv Islamic Finance Development Report 2022 looks at data on over 1,600 Islamic financial institutions.

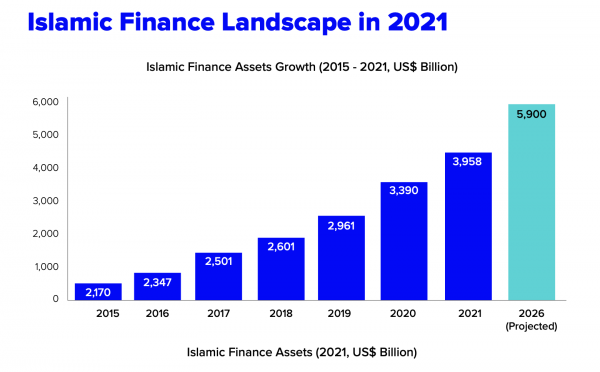

This report found that Islamic finance experienced growth of 17% in 2021, reaching $4 trillion USD worth of assets.

This graph, taken from their report, shows the trend of growth for Islamic financial assets from 2015 to 2021, as well as projections of reaching $5.9 trillion USD by 2026.

The report also found that there are now 47 different countries with at least one type of Islamic finance regulation.

As we can see from its findings, Islamic finance is experiencing steady growth with no signs of stopping or slowing down.

Key Principles of Islamic Finance

- Money should not have value in itself. Rather, it is a measure in which we can exchange goods and services which do have a value. As such, we should not make money off money itself, e.g, from interest

- Prohibition of interest, whether nominal or excessive, fixed or floating, simple or compound. Wealth should only be created through legitimate trade and investment in assets

- Islamic finance should not cause harm. Once again, we can apply the prohibition of interest here; interest on loans is disallowed because it is seen as an agreement which unfairly favours the lender, thus exploiting the borrower. As well as interest being prohibited, any kind of dealings with, or investment in, things that are deemed haraam, is also not allowed. This includes things like gambling, pornography, pork, tobacco and alcohol

- Shariah compliant financial transactions are based on the essential maxim of sharing risks and rewards. Where possible, any risk or profit should be shared, whether between two people, an individual and a business, or two businesses

Shariah Boards

A Shariah Board certifies that Islamic financial products and services are Shariah complaint. Compliance with Shariah law forms the basis of Islamic finance, so many Islamic banks or companies that deal with Islamic finance will have their own Shariah board. These boards are usually comprised of Shariah scholars who are qualified to issue fatwas (religious rulings) on financial transactions.

However, the UK does not have a central authority to ensure Shariah compliance of financial products or services and there is no legal requirement for our Islamic financial institutions to have a Shariah supervisory board.

The Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA) regulate Islamic financial institutions on a basis of “no obstacles, but no special favours.”

This means that in the UK, Islamic financial institutions are treated the same as other conventional firms so need the same kind of authorisations and permissions to carry out financial and business activities.

If an Islamic financial institution does have its own Shariah board, it should provide additional information to the FCA about this.