Increasingly, investors are taking into account non-financial factors when considering potential investment opportunities

What does ESG stand for?

- Environmental

- Social

- Governance

Environmental

The environmental component of ESG investment concerns a company’s impact on the environment. When looking at potential investments, investors may be interested in things like:

- whether a company has policies addressing climate change

- what its energy efficiency is like

- its greenhouse emissions

Global warming is (quite literally) a hot topic in society at the moment. This has led to more investors considering companies’ environmental footprints

Social

This looks at a company’s employee, supplier and customer relations, as well as its relationship with the surrounding community

Regarding customer relations, this may be as simple as wrongful dismissal of employees, or how well the business adheres to health and safety regulations

However, this can also be expanded to cover far broader violations. For companies which undertake production abroad in order to cut costs, investors may be interested in the existence of any exploitative labour practices. For example, any use of child or slave labour or workers working long hours with no breaks

Governance

Governance basically concerns any decision making element of a company and how it is run. This covers things like its leadership, salaries for those in executive roles, audits, and shareholder rights

The ‘G’ component can sometimes be overlooked by those discussing ESG investment. However, it still holds significance, as it concerns all of a company’s policies and internal practices

When looking at companies, investors may ask questions like:

- Are they effective decision makers?

- Is the company run efficiently?

- Does it comply with regulations and laws?

ESG on the rise

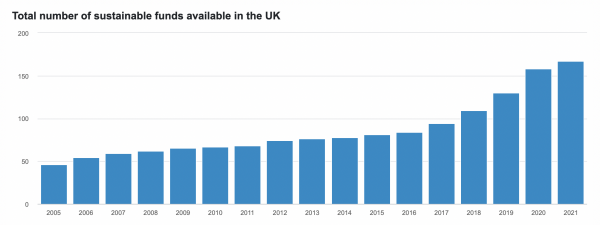

Sustainable investment is clearly on the rise. More and more, investors are considering these ESG factors. Businesses that are socially conscious and completely transparent about their practices tend to fare better amongst investors

Why are investors considering these factors?

ESG factors enable socially conscientious investors to monitor a company’s ethical standards, meaning their investments can reflect their own morals

In recent years, there has been a movement towards sustainable practices. Investor behaviours have began to mirror this societal trend

By considering ESG criteria in their investment opportunities, investors can reduce investment risks. Companies involved in ethical practices often end up being held accountable for their actions, resulting in huge pay-offs. By vetting a company’s ESG practices, investors can avoid these potential losses. Therefore, considering non-financial factors may have a financial pay-off for investors in the long-run